October 03, 2024 (Arlington, VA) – Capital Impact Partners today announced that it has achieved a significant impact investing milestone by issuing more than $500 million of Capital Impact Investment Notes (Notes).

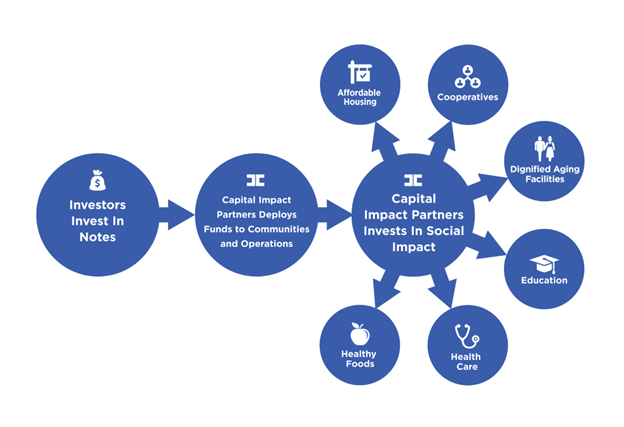

Investing in the Notes helps Capital Impact Partners create social impact in the communities it serves, supporting the creation of more affordable housing; access to quality health care, education and healthy foods; and other important pillars that help build healthy communities and generational wealth.

Capital Impact Partners has partnered with InspereX LLC to distribute the Notes through its Impact Investment Platform to a nationwide network of broker-dealers, institutions, and financial advisors.

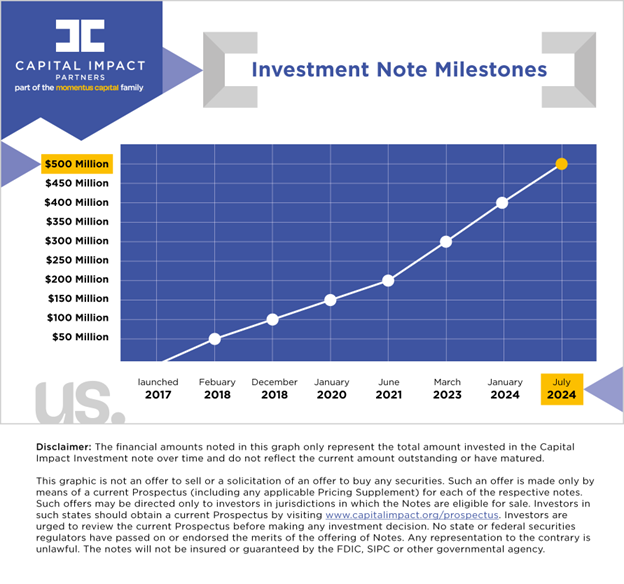

The first Notes were offered in October 2017, making Capital Impact Partners the first Community Development Financial Institution, or CDFI, with a programmatic public debt issuance program. The first $100 million of Notes had been issued by December 2018, and additional milestones have been reached since, passing $200 million in June 2021, $300 million in March 2023, $400 million in January 2024, and $500 million in July 2024.

“We are incredibly grateful that investors who want to align their financial goals with their personal principles have embraced Capital Impact Investment Notes to such a significant extent,” said Natalie Gunn, Chief Financial Officer of Capital Impact Partners and CDC Small Business Finance, which are each part of the Momentus Capital branded family of organizations. “Reaching this latest milestone in less than seven years demonstrates that investors believe in our ability to deliver a strong financial performance while providing disinvested communities with the continuum of financial capital, knowledge capital and social capital so they can have the chance they deserve to thrive.”

“At InspereX, we believe in the power of investments to drive meaningful social impact alongside financial growth. Capital Impact Partners has exemplified this mission, resonating strongly with both individual and institutional investors,” said John DesPrez, CEO of InspereX. “We are excited to celebrate this milestone and look forward to more achievements to come.”

What are Investment Notes?

For some investors, the goal is not only to build wealth, but to do so through value-based investing — directing their money toward efforts that not only create financial returns, but social returns as well, contributing toward the overall community well-being.

The Notes, which are offered at fixed interest rates with multiple terms, are one such tool for these investors. While the 15 largest investors have purchased a combined $326 million in Notes, individual and institutional investors can purchase the Notes for as little as $1,000.

How does Capital Impact Partners utilize funding from the Notes?

Funding from the Notes helps expand Capital Impact Partners’ national footprint through our support of organizations that provide access to critical social services, including health care, education, healthy foods, affordable housing, cooperatives, and dignified aging facilities.

Since its founding more than 40 years ago, Capital Impact Partners has disbursed more than $3 billion to create access to critical social services, grow entrepreneurs, and create quality jobs.

What are the ratings for the Notes?

Fitch Ratings assigned an A+ rating with a stable outlook to Capital Impact Partners and the Notes in September 2023.

S&P Global assigned Capital Impact Partners and the Notes an A+ rating with a stable outlook in September 2023.1

For more information, visit the Capital Impact Investment Notes website.

DISCLAIMER

Disclaimer: This press release is not an offer to sell or a solicitation of an offer to buy any securities. Such an offer is made only by means of a current Prospectus (including any applicable Pricing Supplement) for each of the respective Notes. Such offers may be directed only to investors in jurisdictions in which the Notes are eligible for sale. Investors in such states should obtain a current Prospectus by visiting www.capitalimpact.org/invest/capital-impact-investment-notes. Investors are urged to review the current Prospectus before making any investment decisions. Past performance is no guarantee of future results. No state or federal securities regulators have passed on or endorsed the merits of the offering of the Notes. Any representation to the contrary is unlawful. The Notes are not insured or guaranteed by the FDIC, SIPC or other governmental agency. As of the date hereof, the Notes are offered for sale in all 50 states and the District of Columbia, excluding the States of Arkansas and Washington.

Forward-Looking Statements

This press release contains statements that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Also, when Capital Impact Partners uses any of the words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend” or similar expressions, it is making forward-looking statements. These forward-looking statements are not guaranteed and are based on Capital Impact Partners’ present intentions and on Capital Impact Partners’ present expectations and assumptions. These statements, intentions, expectations, and assumptions involve risks and uncertainties, some of which are beyond Capital Impact Partners’ control, that could cause actual results or events to differ materially from those anticipated or projected. Purchasers of Notes should not place undue reliance on these forward-looking statements, as events described or implied in such statements may not occur. Except as required by law, Capital Impact Partners undertakes no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise.

1Please check the Pricing Supplement for the S&P Global and Fitch credit ratings assigned to Notes currently being offered for sale. A credit rating is not a recommendation to buy, sell or hold Notes and may be subject to suspension, reduction or withdrawal at any time by the applicable credit rating agency.

About Capital Impact Partners:

Capital Impact Partners, part of the Momentus Capital branded family of organizations, is transforming how capital and investments flow into communities to provide people with access to the capital and opportunities they deserve. As one of the nation’s leading mission-driven Community Development Financial Institutions, we champion key equity, social justice, and economic justice issues by deploying mission-driven financing, capacity-building programs, and impact investing opportunities.

Capital Impact Partners offers flexible financing for catalytic mission-aligned projects in four primary sectors: increasing access to health care, education, affordable housing, and healthy food.

In addition, we manage several multi-year initiatives in key regions to support emerging developers, small business owners, cooperatives, and community health enterprises through training, professional networks, access to experts and mentors, and pathways to grants and loan capital.

Capital Impact Partners has disbursed over $3 billion since 1982 to create access to critical social services, grow entrepreneurs, and create quality jobs. Capital Impact Partners’ leadership in delivering financial and social impact has resulted in the organization being rated by S&P Global and Fitch Ratings and recognized by Aeris for its performance.

With headquarters in Arlington, Virginia, and San Diego, California, Momentus Capital operates nationally with a focus on larger urban areas and cities in Arizona, California, Georgia, Michigan, Nevada, New York, Texas, and the Washington D.C. metro area.

Learn more at capitalimpact.org and momentuscap.org.

About InspereX:

InspereX is transforming how fixed income securities and market-linked products are accessed, evaluated, and traded. Home to the pioneering BondNav® platform — one of the first cloud-native bond aggregation platforms — InspereX provides financial advisors, institutional investors, issuers, and risk managers deep access to fixed income market data across asset classes, as well as industry-leading origination, distribution, and education in market-linked products. Focused on delivering true price transparency, liquidity, execution targeting price improvement, and the information advantage gained through data aggregation, InspereX inspires greater confidence through the power of technology.

The firm is a leading underwriter and distributor of securities to more than 1,500 broker-dealers, institutions, asset managers, RIAs, and banks. InspereX represents more than 400 issuing entities and has underwritten more than $705 billion in securities. The firm has seven trading desks and more than 200 employees with principal offices in Delray Beach, San Francisco, Chicago, and New York City.

Comments are closed.